I own 2015 3.8 awd with 90k miles. I leased it out and purchased the lease. Currently i have $23k left on my loan And my car is worth about $14k my commute everyday is about 120 milles round trip. I am really considering getting a Tesla model 3. I know i am upside down at least $9k. Would i ever meet breaking even point? Or will my car depreciate even more if i continue to put those miles on?

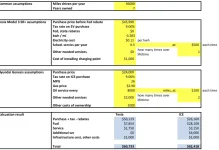

If you compare it car for car

Genesis car payment + gas + maintance + registration + insurance costs more than tesla payment + electricity to charge at home + registration +

Bro, what follows may sound preachy, and please forgive me if it does.

Some old adages apply here: (1) If you find yourself in a deep hole, stop digging. (2) (paraphrase from Dave Ramsey) "When you are young, live like nobody else so, when you are old, you can live like nobody else."

Back when J. Paul Getty was the world's richest man, a reporter asked him "Why do you drive a Chevy Bel Air when you can afford a

Cadillac."

His response: "I didn't become the world's richest man by purchasing fast-depreciating assets."

Buying more (new) car than you can afford is one of the biggest financial mistakes you can make. And you made it once. Don't make it twice!

It seems like you chose 3 years ago to drive a car you probably shouldn't have bought. You leased the car, paid a ton of interest, and now find yourself underwater. So stop digging! Distinguish between your wants and your needs. You *want* the technology/hype Tesla. The reality is that

the car offers a very significant probability of lemon-hood, and has (as others have pointed out) significant hidden cost potential, not to mention a'

non-negligible potential for becoming an orphan. What you *need* is a safe, reliable car. Kia makes some cars that are great looking, reliable, and cheap. So does Honda.

In my youth, I drove incredible beaters until I could pay cash for a car. Then, when I could afford to cash buy, I drove Accords and a Maxima. At age 53 I was in a terrific

Buick Park Avenue Ultra which I drove for 6 years, followed by an Accord 6 which I paid $21,300 for and drove for 6 years, and when it was totaled by another driver in 2010, State Farm gave me $13,000.

I paid $31,000 cash for a new 2010 base Genesis 3.8, drove it 5.5 years, and sold it to CarMax for $15,000. It was garaged indoors, washed every week or two, and looked (literally!) like new when I sold it. Now I'm in my second 2015 Genesis. Mine cost me $40,000US in Canada. Other than one parking lot ding, (easily fixed with paintless dent removal), it looks like new.

If you are on the highway for 100 miles a day, you need a safe, reliable car. Period. Create a 6 year plan. Buy an Accord and slap a Honda Care warranty on it, or drive your Genny until it drops. Do not incur any more debt. Pay down your current loan as fast as you can.

Because I "lived like nobody else" in my neighborhood and income bracket when I was young, I'm now able to pay cash, literally, for virtually any car on the market. I have no debts, not one penny. I choose to drive a Genesis because it is built like a Sherman tank, offers great comfort for a tall man, and has adequate performance in a suburban city environment. But if I was in my 20's, I'd be driving a 5 year old Corolla or Camry.