troyjoo

New member

- Joined

- Oct 26, 2021

- Messages

- 1

- Reaction score

- 0

- Points

- 1

- Genesis Model Year

- 2016

- Genesis Model Type

- 2G Genesis Sedan (2015-2016)

Hi,

Since there is confusion, I add a few notes.

Did anyone experience that Hyundai Motor Finance requesting property tax after lease-end?

Some states collect property taxes on vehicles yearly.

I have experienced very unpleasant situation with Hyundai Motors Finance and wonder if it is pattern of HMF.

My lease ended in 2019. Then HMF has continuously billed me for 2 years for property taxes for 2020 & 2021.

I was located to outside of US for 2019 ~ 2021. After I came back I found out past due statements of 2 years property taxes.

HMF could not even explain whether HMF reported delinquency for that or not.

I have to find out myself if this has impacted negative on my credit score.

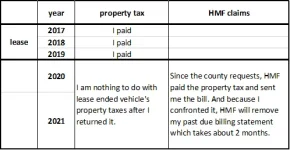

During the 3 years 2016 ~ 2019

1. I have paid property taxes for all 3 years.

2. HMF paid the taxes to the county first, then I paid to HMF

But HMF sent a bill statement to me for 2020 & 2021 property taxes after lease ended at 2019.

I called HMF service center, then surprisingly I heard it's very common practice for HMF.

1. pay if the county requests the property tax

2. try to reimburse from the customer

3. until customer confront it, HMF will not settle with the county about property tax

It was sharking to hear all these.

1. HMF claimed to sell the vehicle right after lease-end

2. then HMF is not responsible for property tax from the first place

3. if lease-ended customer just pay the bill statements without checking property tax issue

4. HMF may wrongly charge it's customers

Please share if anyone shares the similar experience.

TJ

Since there is confusion, I add a few notes.

Did anyone experience that Hyundai Motor Finance requesting property tax after lease-end?

Some states collect property taxes on vehicles yearly.

I have experienced very unpleasant situation with Hyundai Motors Finance and wonder if it is pattern of HMF.

My lease ended in 2019. Then HMF has continuously billed me for 2 years for property taxes for 2020 & 2021.

I was located to outside of US for 2019 ~ 2021. After I came back I found out past due statements of 2 years property taxes.

HMF could not even explain whether HMF reported delinquency for that or not.

I have to find out myself if this has impacted negative on my credit score.

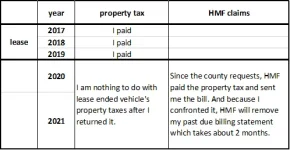

During the 3 years 2016 ~ 2019

1. I have paid property taxes for all 3 years.

2. HMF paid the taxes to the county first, then I paid to HMF

But HMF sent a bill statement to me for 2020 & 2021 property taxes after lease ended at 2019.

I called HMF service center, then surprisingly I heard it's very common practice for HMF.

1. pay if the county requests the property tax

2. try to reimburse from the customer

3. until customer confront it, HMF will not settle with the county about property tax

It was sharking to hear all these.

1. HMF claimed to sell the vehicle right after lease-end

2. then HMF is not responsible for property tax from the first place

3. if lease-ended customer just pay the bill statements without checking property tax issue

4. HMF may wrongly charge it's customers

Please share if anyone shares the similar experience.

TJ

Last edited: