Grayson

Registered Member

- Joined

- Jul 16, 2023

- Messages

- 753

- Reaction score

- 316

- Points

- 63

- Location

- Maryland, USA

- Genesis Model Year

- 2023

- Genesis Model Type

- Genesis GV60

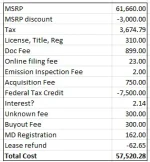

If you want to lease and buy-out, this is what I did.

1) Get price of car with no add-ons. (Negotiate MSRP price as low as possible)

2) Ask for the HMF Lease Cash Offer (-$7500)

3) Wait for lease to be transferred to Genesis Finance

4) Sign HMF Lease

5) Secure your Financing for payoff if you need financing. Otherwise, skip this step

6) Create account with Genesis Finance once they've received the lease

7) Request Buyout on the Genesis Finance website. If the numbers don't reflect the first month payment, wait a few days until they do. Note that there is a $300 buyout fee

8) Give your financing the buyout quote (if you did step #5), or get a cashier's check from your bank. Follow mail-in instructions (or take to dealer if your state requires in person payoff)

9) Wait for check to be cashed

10) Request Plate Transfer if transferring existing plates. Otherwise, skip this step

10) Wait for Genesis Finance to mail you the title.

11) Request Bill of Sale from Genesis Finance. They sent it to me via e-mail.

12) Take Title, Bill of Sale, and Lease Agreement to DMV. I had to pay $162 to register in MD.

1) Get price of car with no add-ons. (Negotiate MSRP price as low as possible)

2) Ask for the HMF Lease Cash Offer (-$7500)

3) Wait for lease to be transferred to Genesis Finance

4) Sign HMF Lease

5) Secure your Financing for payoff if you need financing. Otherwise, skip this step

6) Create account with Genesis Finance once they've received the lease

7) Request Buyout on the Genesis Finance website. If the numbers don't reflect the first month payment, wait a few days until they do. Note that there is a $300 buyout fee

8) Give your financing the buyout quote (if you did step #5), or get a cashier's check from your bank. Follow mail-in instructions (or take to dealer if your state requires in person payoff)

9) Wait for check to be cashed

10) Request Plate Transfer if transferring existing plates. Otherwise, skip this step

10) Wait for Genesis Finance to mail you the title.

11) Request Bill of Sale from Genesis Finance. They sent it to me via e-mail.

12) Take Title, Bill of Sale, and Lease Agreement to DMV. I had to pay $162 to register in MD.