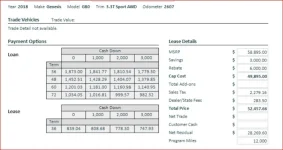

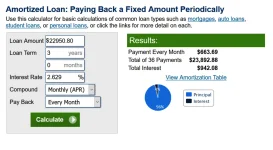

I think that the problem with your comparison is that if you purchase the car, you wouldn't just be paying interest on the $22,950 depreciation that occurs during the three-year period; you'd be paying interest on the entire cost of the car (minus any down payment, of course). So figuring a sales price of $52,362 and an interest rate of 1.9% over the same 36-month period, the total amount of interest you would pay would be $1,548. And if you took out a 5-year loan, the amount of interest you'd pay during that first 36-month period would be even higher because you wouldn't have paid down as much of the principal. Or to state it more simply, if the purchase price is the same, then it is mathematically impossible to pay more interest on a lease as opposed to a purchase if the lease APR is lower than the purchase loan APR.

In your example above, you computed the monthly interest charge on a lease to be $26.17. Well, on a purchase with a 1.9% loan, you're going to start out with a monthly interest charge almost triple that amount ($83). Even after two years, you're still paying more in monthly interest charges than you would be on a lease ($28->$26.17).

As noted previously, not only is the interest rate APR lower on the lease, but you're only paying interest on the amount of the car that you actually use rather than the whole car. Moreover, in many states, you'd only be paying sales taxes on that lesser amount as well. (Although if you were to ultimately purchase the car at the end of the lease, then this would be a wash.)

Now, I'm not saying that leasing is always the better choice, but if you don't have a car to trade in, and you're going to finance a purchase anyway, then leasing definitely has some advantages. And one of the big one's is that it puts the onus on Genesis to value the car correctly three years in advance. Because if they don't, and the car is not worth $29k in three years time, then you just hand over the keys to them and they have to eat all that added depreciation and then try to sell the car for $25k or whatever lesser amount it is worth at that point in time.