Badger

New member

- Joined

- Apr 8, 2023

- Messages

- 29

- Reaction score

- 10

- Points

- 3

- Genesis Model Year

- 2023

- Genesis Model Type

- Genesis GV60

Hello! I’m eager to finalize things for a GV60 but I’m having a bit of trouble getting the finance contact at my dealership to understand the early buyout concept, he’s saying I’d pay the residual listed on the contract as remaining at lease end, plus all monthly payments, even if I buy out lease in first month. That is what I’d expect for an early RETURN not a buyout. (Instead I’m hoping to get a residual price reflecting a car’s price one month into lease instead of 36 months, and not have to pay the remaining 35 months of lease/rental/interest fees.)

I’ve ready this thread and the original Ionic thread. Expecting to have a second chat with the finance guy on Monday. Is this basic recap right?

———-

Pulled from an online dealer lease page:

Base Model $68,290

Packages $280 (cargo $230, safety kit $50)

Premium Colors and Trims $575

Manufacturer Destination Charge $1,125

MSRP (Sticker Price) $70,270

Dealer-Installed Equipment $990

(Paint & Fab Prot $495, Window Tint $495)

Dealer Discount -$699

Genesis Dealer Price $70,561

Manufacturer Rebate -$7,500

Total Purchase Price $63,061

LEASE SUMMARY

Term 36 months

Annual Mileage 12,000

Residual Value (51%)

$35,838

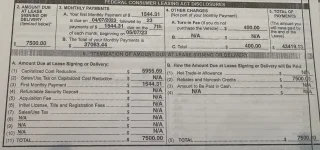

Total Due At Signing

$2,500

Sales tax includes $1,895.47 (6.6%) state taxes.

Registration & Fees include $47.00 DMV fee, and $699.00 documentation fee.

Security deposit waived. The capitalized cost of your lease is the Dealer’s Price plus $750 lease acquisition fee.

The monthly payment includes TAVT and acquisition fee paid over 36 months, and includes all taxes and fees and any manufacturer rebates. The monthly payment includes a lease acquisition fee of $21.00 ($750 paid over 36 months).

12,000 miles per year with 25¢/mile overage charge.

This is generic generated lease info from the dealer website and doesn’t exactly fit my scenario as I’m buying from the adjacent state and tax/registration will be handled differently. But for the sake of helping me talk to the finance guy these calculations are a place to start.

——

Basically car is $70,561

Minus $7,500 lease rebate is $63,062

Pay $2,500 on signing includes the $1,168 first payment

Not sure where these other bits fit in:

Capitalized Cost Increase: -$563

TAVT $1,895

Monthly Payment $1,167.77

Sales tax includes $1,895.47 (6.6%) state taxes.

Registration & Fees include $47.00 DMV fee, and $699.00 documentation fee.

The capitalized cost of your lease is the Dealer’s Price plus $750 lease acquisition fee.

——

$63,062 lease price after rebate

-$2,500 on signing (includes $1,168 first payment)

=$60,562 Residual price?

——

So would I then expect to pay $60,562 in the next week as the residual price to buyout the lease early and own the vehicle, plus maybe that $750 “lease documentation fee” and $699 “documentation fee”?

Are those documentation and lease fees already wrapped into what I’ve paid on signing? I’m getting properly confused on the capitalization cost increase, TAVT, lease documentation fees, and documentation fees, and unfortunately my husband it’s savy on this stuff either.

Appreciate any help I can get navigating this stuff. Saving most of $7,500 is motivating! Thank you. Can’t wait to get the car.

I’ve ready this thread and the original Ionic thread. Expecting to have a second chat with the finance guy on Monday. Is this basic recap right?

———-

Pulled from an online dealer lease page:

Base Model $68,290

Packages $280 (cargo $230, safety kit $50)

Premium Colors and Trims $575

Manufacturer Destination Charge $1,125

MSRP (Sticker Price) $70,270

Dealer-Installed Equipment $990

(Paint & Fab Prot $495, Window Tint $495)

Dealer Discount -$699

Genesis Dealer Price $70,561

Manufacturer Rebate -$7,500

Total Purchase Price $63,061

LEASE SUMMARY

Term 36 months

Annual Mileage 12,000

Residual Value (51%)

$35,838

Total Due At Signing

$2,500

- First Payment

$1,168 - Capitalized Cost Increase

-$563 - TAVT$1,895

Sales tax includes $1,895.47 (6.6%) state taxes.

Registration & Fees include $47.00 DMV fee, and $699.00 documentation fee.

Security deposit waived. The capitalized cost of your lease is the Dealer’s Price plus $750 lease acquisition fee.

The monthly payment includes TAVT and acquisition fee paid over 36 months, and includes all taxes and fees and any manufacturer rebates. The monthly payment includes a lease acquisition fee of $21.00 ($750 paid over 36 months).

12,000 miles per year with 25¢/mile overage charge.

This is generic generated lease info from the dealer website and doesn’t exactly fit my scenario as I’m buying from the adjacent state and tax/registration will be handled differently. But for the sake of helping me talk to the finance guy these calculations are a place to start.

——

Basically car is $70,561

Minus $7,500 lease rebate is $63,062

Pay $2,500 on signing includes the $1,168 first payment

Not sure where these other bits fit in:

Capitalized Cost Increase: -$563

TAVT $1,895

Monthly Payment $1,167.77

Sales tax includes $1,895.47 (6.6%) state taxes.

Registration & Fees include $47.00 DMV fee, and $699.00 documentation fee.

The capitalized cost of your lease is the Dealer’s Price plus $750 lease acquisition fee.

——

$63,062 lease price after rebate

-$2,500 on signing (includes $1,168 first payment)

=$60,562 Residual price?

——

So would I then expect to pay $60,562 in the next week as the residual price to buyout the lease early and own the vehicle, plus maybe that $750 “lease documentation fee” and $699 “documentation fee”?

Are those documentation and lease fees already wrapped into what I’ve paid on signing? I’m getting properly confused on the capitalization cost increase, TAVT, lease documentation fees, and documentation fees, and unfortunately my husband it’s savy on this stuff either.

Appreciate any help I can get navigating this stuff. Saving most of $7,500 is motivating! Thank you. Can’t wait to get the car.