In case you need more information, I am that "guy."

. My handle is the same in all 3 forums, and yes, we have a GV60, EV-6, and I5s (3; this lease purchase was our last pickup). Our first two I5s were purchased on reserved when the credit was still accessible before IRA kicked in.

1) Yes, the lease translates to a pass through now for the $7500 credit since we wouldn't get it due to the IRA changes

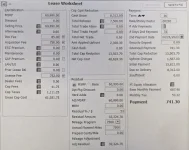

2) Yes, Hyundai Motor Financing has an early purchase clause where you can immediately buyout and basically just pay the Adjusted Cap Cost (more on that later) + $300 for the lease fee.

2a) Yes, some states will make you pay taxes on a secondary purchase transaction but this is not the norm.

2b) Maryland (where I live) has the same clause as Texas, but for some reason Texas' implementation is all over the place. In MD, if the purchaser is the same person(s) as the original leasee, no second tax charge.

3) We bought the i5 on the 4th and had the buyout quote on the 9th; mailed the check on the 10th.

Questions, feel free to ask. Happy to help anywhere I can.