Unprocessed1

Registered Member

- Joined

- Dec 23, 2020

- Messages

- 187

- Reaction score

- 63

- Points

- 28

- Genesis Model Year

- 2022

- Genesis Model Type

- Genesis GV70

So I drove 200 miles in a different state to pick up my GV70.

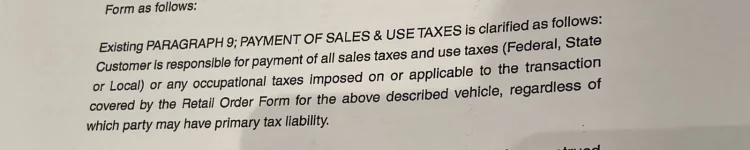

The sales manager and I agreed on the price and monthly payment in advance of the delivery and he sent me a detailed price sheet that I have a copy of. However, when I was at the dealership reviewing the lease documents, I noticed they only put down about half of the sale tax that I thought should be paid in my state. When I asked the finance guy about it, he said not to worry about it and that "we've had several customers in your state, and it's the way we always calculate it and we've never had an issue." It was my fault for not pushing back more aggressively but I was exhausted at that point and just wanted to take delivery and go home.

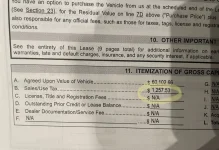

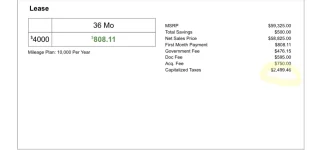

A day later and getting a chance to review the lease contract, I believe the dealer sold me the leased car at the agreed-upon price and monthly payment by deceivingly marking up the actual price of the car and reducing the amount of sales tax to make up the difference, which is almost $1,300.

I don't think this is a mistake because the original detailed price estimate from the sales manager (which I agreed to) listed the car sales price for a little below MSRP and seemingly had the correct sales tax amount for my state and had an all-inclusive monthly payment. In fact, the monthly payment is what we agreed to, it just arrives at the number differently...

My concern is that why they try to register the car and get me the plates, they're going to call me and say I owe them another $1,300 in taxes as a way of forcing me to pay a markup for the car when the sales manager told me there was no markup.

What would my recourse be in the event they try to ask me for additional money? Unless it's just sheer incompetence on their part, it would mean their sales manager wasn't honest when he sent me the pricing sheet and we agreed on the deal. I'm inclined to escalate it to Genesis corporate and fight it if they try to shake me down for more money than we agreed on.

The sales manager and I agreed on the price and monthly payment in advance of the delivery and he sent me a detailed price sheet that I have a copy of. However, when I was at the dealership reviewing the lease documents, I noticed they only put down about half of the sale tax that I thought should be paid in my state. When I asked the finance guy about it, he said not to worry about it and that "we've had several customers in your state, and it's the way we always calculate it and we've never had an issue." It was my fault for not pushing back more aggressively but I was exhausted at that point and just wanted to take delivery and go home.

A day later and getting a chance to review the lease contract, I believe the dealer sold me the leased car at the agreed-upon price and monthly payment by deceivingly marking up the actual price of the car and reducing the amount of sales tax to make up the difference, which is almost $1,300.

I don't think this is a mistake because the original detailed price estimate from the sales manager (which I agreed to) listed the car sales price for a little below MSRP and seemingly had the correct sales tax amount for my state and had an all-inclusive monthly payment. In fact, the monthly payment is what we agreed to, it just arrives at the number differently...

My concern is that why they try to register the car and get me the plates, they're going to call me and say I owe them another $1,300 in taxes as a way of forcing me to pay a markup for the car when the sales manager told me there was no markup.

What would my recourse be in the event they try to ask me for additional money? Unless it's just sheer incompetence on their part, it would mean their sales manager wasn't honest when he sent me the pricing sheet and we agreed on the deal. I'm inclined to escalate it to Genesis corporate and fight it if they try to shake me down for more money than we agreed on.